Award-winning PDF software

How to prepare CMS-40B

About CMS-40B

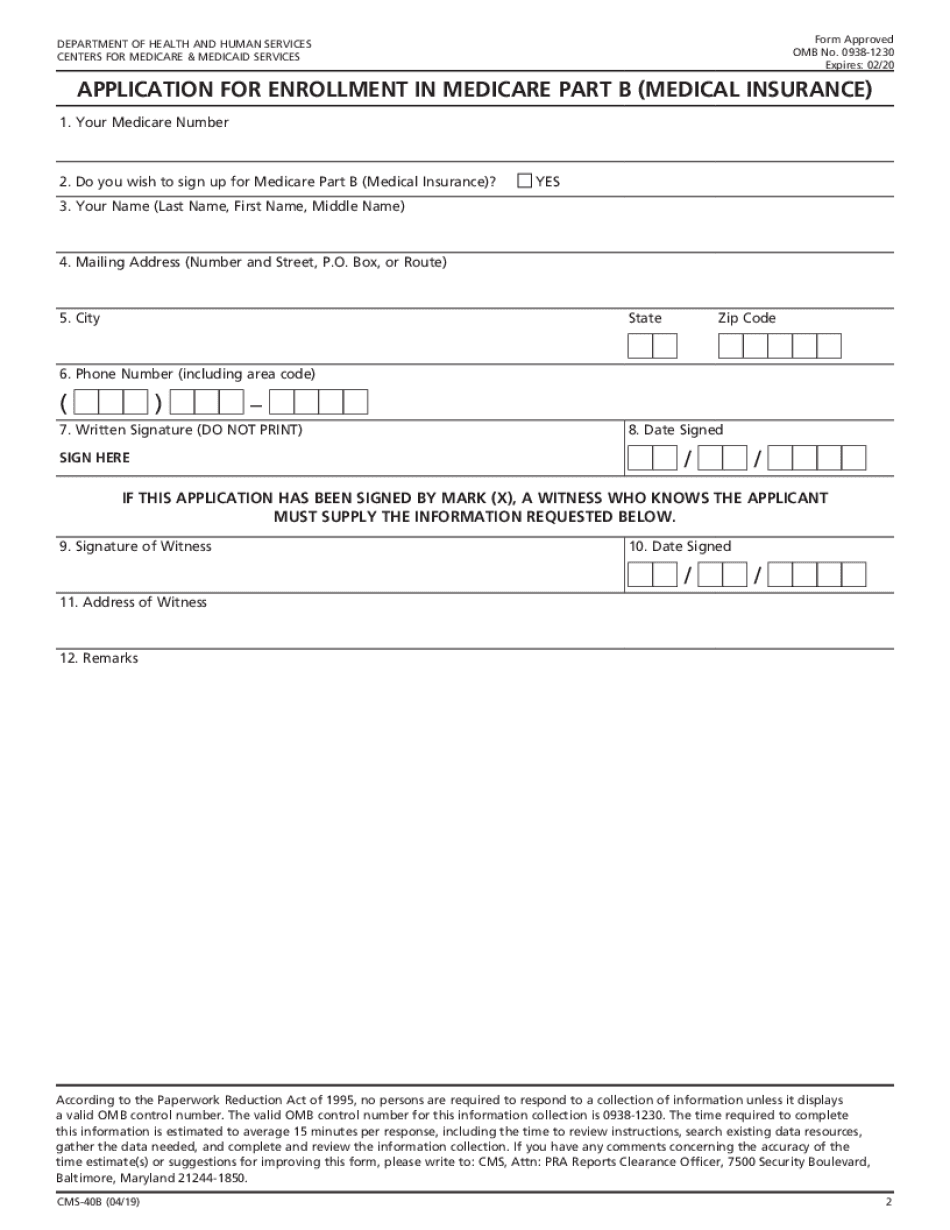

CMS-40B is a form used by the Centers for Medicare and Medicaid Services (CMS). It is titled "Application for Enrollment in Medicare - Part B (Medical Insurance)." This form is used by individuals who are eligible for Medicare Part B and wish to enroll or delay enrollment. Medicare is a federal health insurance program primarily targeting individuals who are 65 years or older. Part B of Medicare specifically covers medical services such as doctor visits, preventive services, outpatient care, and medical supplies. It is voluntary coverage with a monthly premium. People who are eligible for Medicare Part A (hospital insurance) and wish to enroll in Part B or delay enrollment because they have other health coverage may use CMS-40B. For instance, an individual who is 65 or older and continues to work and receive health insurance from their employer may choose to delay enrolling in Part B until such coverage ends. It is essential to submit CMS-40B to ensure a seamless enrollment process in Medicare Part B or to avoid penalties for late enrollment.

Online technologies allow you to organize your file administration and improve the productivity of your workflow. Look through the quick information to complete CMS-40B, avoid mistakes and furnish it in a timely manner:

How to complete a Cms 40b Printable?

-

On the website containing the blank, press Start Now and pass for the editor.

-

Use the clues to complete the pertinent fields.

-

Include your individual details and contact information.

-

Make absolutely sure that you choose to enter appropriate details and numbers in correct fields.

-

Carefully check the information in the blank as well as grammar and spelling.

-

Refer to Help section in case you have any concerns or contact our Support team.

-

Put an electronic signature on the CMS-40B printable using the support of Sign Tool.

-

Once the form is done, press Done.

-

Distribute the ready document by using email or fax, print it out or download on your device.

PDF editor will allow you to make changes to your CMS-40B Fill Online from any internet linked device, customize it in accordance with your needs, sign it electronically and distribute in several ways.