Today we're going to discuss the most common situations when enrolling in Medicare Part A and Medicare Part B. So, don't touch that dial! Hi, I'm Tim Hanbury, author of Medicare Blueprint. We're going to go over the most common situations that were asked about when enrolling in Medicare Part A and Medicare Part B. Be sure to stay to the end of the video to receive your free offer. Now, let's get started. The first scenario is: I'm turning 65 in three months and I currently receive my Social Security income benefits. What do I do? If you're already receiving Social Security benefits before turning 65, you don't have to do anything. The Social Security Administration will automatically enroll you in Medicare Part A and Medicare Part B. You'll receive your red, white, and blue Medicare card in the mail, usually about three months before you turn 65. However, if you work for a company with more than 20 full-time employees and are staying on the group insurance plan at work, you usually don't need Part B coverage. If you want to decline Part B, then you'll need to follow the instructions that come with your Medicare ID card and send the card back. We do recommend that you compare your Medicare options with your current employer's coverage. Most times, we've found that Medicare with a supplement can provide better coverage at a lower cost. If you do decide to keep the card, you automatically keep Part B and you'll need to pay the Part B premium. If you decide to stay on your employer's plan, then when you come off the employer's plan sometime down the road, you'll need to sign up for Part B coverage at that time. Be aware that there are penalties for not signing up...

Award-winning PDF software

Cms-l564 Form: What You Should Know

Social Security needs to see proof that the beneficiary or dependent applicant is covered by both Medicare and Medicaid. If the beneficiary can provide proof of Medicare coverage, he or she will be given a special enrollment period to enroll in Medicaid. REQUEST FOR EMPLOYMENT INFORMATION — Internal Revenue Service Form 1040 (EIC) REQUEST FOR INFORMATION. REQUEST FOR EMPLOYMENT INFORMATION. Revision Date. . U.S. BUREAU OF INSURANCE. FORM APPROVED. P.O. BOX 2142, WASHINGTON, DC 20031. O.M.B. # 12-0387. September 27, 2025 — Form 1040 (EIC) is an income and expenses tax form for Social Security. It's used by the IRS to determine payment of Social Security benefits and is an easy way of verifying eligibility.

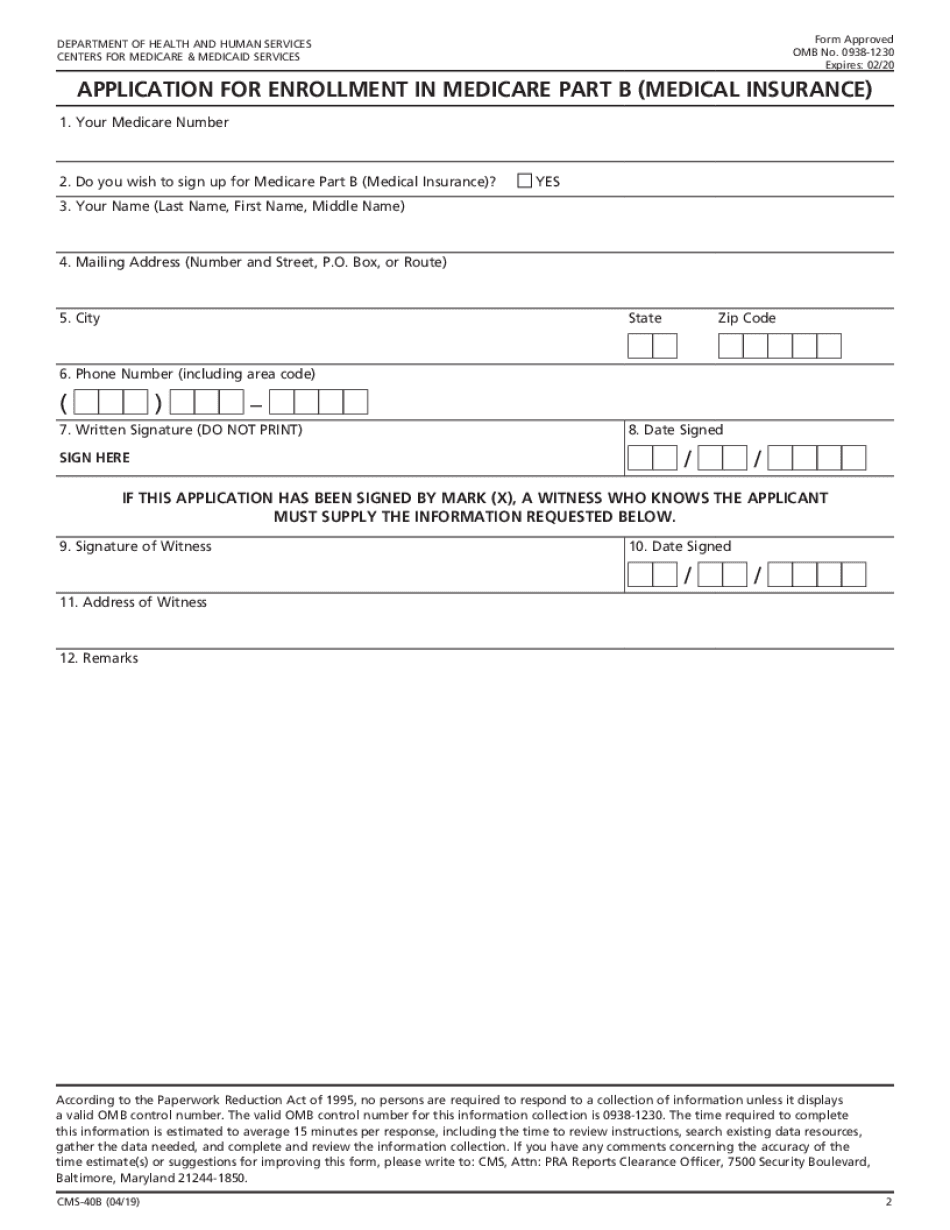

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do CMS-40B, steer clear of blunders along with furnish it in a timely manner:

How to complete any CMS-40B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your CMS-40B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your CMS-40B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cms-l564